Financial stability isn’t just a buzzword—it’s the backbone of sustainable business growth. For business professionals, understanding how to navigate and strengthen financial systems amidst disruptions like market volatility, cyberattacks, or geopolitical tensions is critical. This article breaks down what financial stability means in 2025, offers actionable strategies powered by technology, and draws lessons from real-world successes to help you safeguard your organization’s future.

What Is Financial Stability, Really?

Financial stability is the ability of a financial system—banks, markets, and infrastructure—to support economic growth, manage risks, and weather shocks without collapsing. Think of it as a tightrope: balance is key, but the winds of change (inflation, tech disruptions, or global crises) are always blowing. Unlike a static state, stability exists on a continuum, adapting to new realities like digital currencies or AI-driven trading.

Why should business leaders care? A stable financial system ensures access to capital, smooth transactions, and confidence in investments—crucial for scaling operations or seizing market opportunities.

Why Financial Stability Matters Now?

The 2025 landscape is volatile. The IMF’s Global Financial Stability Report (April 2025) warns that geopolitical risks, such as military conflicts, can spike sovereign risk premiums and crash stock prices, threatening macro-financial stability. Meanwhile, technologies like blockchain and AI are reshaping finance, offering both opportunities and risks. For instance, cyberattacks on financial institutions rose 22% globally in 2024, per Deloitte, exposing vulnerabilities in digital infrastructure.

Business professionals must act proactively to protect their firms and leverage these trends. Here’s how.

Actionable Strategies for Business Leaders

1. Harness AI for Risk Management

AI isn’t just for tech giants—it’s a game-changer for financial stability. Machine learning models can predict market swings or detect fraud faster than traditional methods. For example, JPMorgan Chase’s COiN platform uses AI to analyze legal documents, saving 360,000 hours annually and reducing risk exposure.

Action: Invest in AI-driven analytics tools to monitor cash flow, credit risks, and market trends in real time. Partner with data experts to customize solutions for your industry.

2. Embrace Blockchain for Transparency

Blockchain technology ensures secure, transparent transactions, reducing counterparty risks. In 2023, Maersk and IBM’s TradeLens platform streamlined global trade with blockchain, cutting paperwork costs by 15% and boosting trust among partners.

Action: Explore blockchain for supply chain finance or cross-border payments. Start small with pilot projects to test ROI before scaling.

3. Stress-Test Your Financial Models

Regular stress testing simulates worst-case scenarios—like a cyberattack or sudden rate hike—revealing weaknesses. The 2008 financial crisis taught us that untested systems crumble under pressure. Today, firms like Goldman Sachs run quarterly stress tests, adjusting strategies based on results.

Action: Conduct bi-annual stress tests with your finance team. Use cloud-based simulation tools for efficiency and accuracy.

4. Diversify Revenue Streams

Overreliance on a single market or product is a recipe for instability. During the 2020 pandemic, Zoom diversified into Zoom Phone and Events, offsetting risks as competitors faltered.

Action: Analyze your portfolio and identify new markets or services. Allocate 10-15% of your budget to innovation projects to hedge against downturns.

5. Build Cyber Resilience

With financial institutions facing 1,000+ cyberattacks daily (IBM Security, 2024), cybersecurity is non-negotiable. In 2021, Colonial Pipeline’s ransomware attack disrupted fuel supplies, costing $4.4 million in ransom and millions more in losses.

Action: Audit your cybersecurity protocols and train staff on phishing risks. Partner with tech firms for advanced threat detection systems.

Case Studies: Stability in Action

Case Study 1: DBS Bank’s Digital Transformation

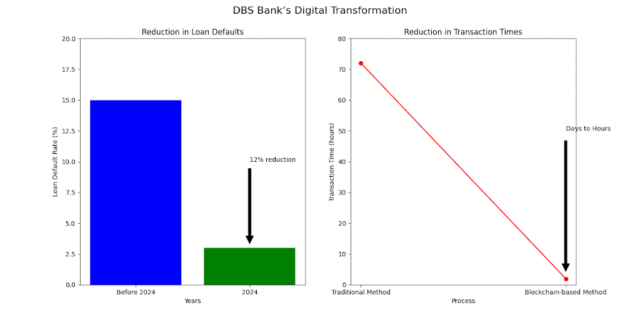

Singapore’s DBS Bank embraced technology to bolster stability. By 2024, its AI-driven credit scoring system reduced loan defaults by 12%, while blockchain-based trade finance cut transaction times from days to hours. Result? DBS was named the “World’s Best Bank” by Euromoney in 2024, even amidst global uncertainty.

Lesson: Integrate tech strategically to enhance efficiency and trust.

Case Study 2: Tesla’s Cash Reserve Strategy

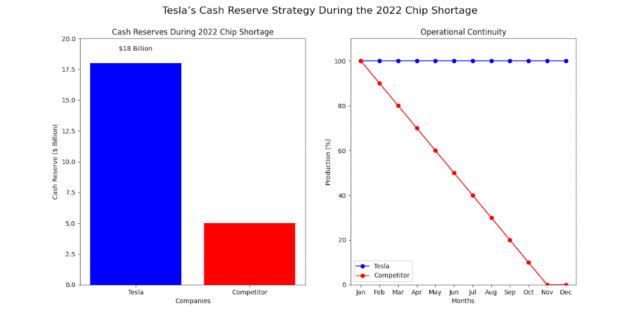

During the 2022 chip shortage, Tesla’s $18 billion cash reserve allowed it to absorb supply chain shocks without borrowing. This liquidity buffer ensured operational continuity, unlike competitors who faced production halts.

Lesson: Maintain robust reserves to navigate unexpected crises.

Current Trends Shaping Financial Stability

Digital Currencies: Central bank digital currencies (CBDCs), like China’s digital yuan, are gaining traction, with 130 countries exploring them (BIS, 2025). They promise faster, cheaper transactions but require businesses to adapt payment systems.

Sustainable Finance: ESG (Environmental, Social, Governance) investments hit $40 trillion globally in 2024 (Bloomberg). Aligning with green finance can attract capital and mitigate regulatory risks.

RegTech: Regulatory technology automates compliance, cutting costs by 30% for firms like HSBC (Forbes, 2024). It’s a must for navigating complex global rules.

Call to Action: Stay ahead by attending industry webinars or consulting with fintech experts to align your strategy with these trends.

How to Get Started Today

Financial stability starts with informed decisions. Here’s a quick checklist for business leaders:

- Audit: Assess your exposure to market, credit, and cyber risks.

- Innovate: Pilot one new tech solution (AI, blockchain) this quarter.

- Learn: Subscribe to IMF or Deloitte reports for real-time insights.

- Connect: Network with peers at finance conferences to share best practices.

By acting now, you’ll position your business to thrive, no matter the economic weather.

Why Trust These Insights?

Our recommendations are grounded in data from credible sources like the IMF, Deloitte, and Bloomberg, combined with real-world examples from industry leaders. Financial stability isn’t theoretical—it’s a practical goal you can achieve with the right tools and mindset.

Need Expert Help?

Struggling to analyze risks or implement tech solutions? QubitStats offers cutting-edge Data Analytics services tailored for business professionals. From predictive modeling to cybersecurity audits, our team empowers you with actionable insights. Contact QubitStats today to secure your financial future.